Month in Review

- Strong US earnings powered markets higher in July (+2.24%, S&P 500 TR Index), led by Technology and growth stocks. Microsoft joined Nvidia in becoming the second $4tn market cap company in history.

- US large cap growth stocks finished the month up +3.78% (Russell 1000 Growth TR Index), pushing concentration higher in US large cap indices. The top 10 companies in the S&P 500 Index now represent nearly 40% of the index, the most concentrated in at least 50 years.

- Nvidia’s 8% weight in the S&P 500 as of 7/31/2025 is unusually high relative to the history of the index. For comparison, the 8% weight of the single company is nearly equal to the weight of the entire Industrials Sector in the S&P 500 index.

- International stocks fell -1.40% (MSCI EAFE NR USD Index) during July, as the US Dollar rose sharply against most major currencies. The MSCI EAFE NR USD Index still stands at +17.77% YTD.

- Major bond markets fell slightly in July (-0.26%, Bloomberg Barclays Aggregate Bond TR Index), as investors digested the outlook for the economy and monetary policy.

Diversification with Bonds

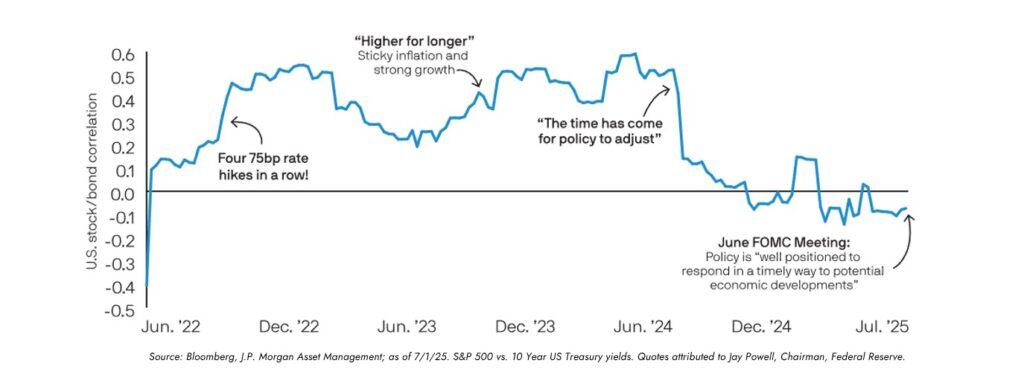

The sharp increase in inflation rates in 2021-2022 not only resulted in a significant drawdown for bond indices, but also sharply shifted the relationship between stock and bond prices. The correlation of US stocks and bonds increased to the highest level in 30 years in 2022, which had real implications for investors: the bond allocation did not provide a ballast during the equity market volatility.

Historically, periods of sustained higher inflation have resulted in a positive correlation between US stocks and bonds (meaning a reduced diversification benefit). From 2001 to 2022, the short- and long-term correlation between US stocks and bonds stayed negative, meaning bond prices rose when stock prices fell. After resetting higher to positive territory in 2022, recent short-term correlation measures have recently shifted negative again, as the Federal Reserve has begun to normalize monetary policy.

The chart illustrates the one-year correlation between US stocks and bonds, annotated with monetary policy developments. As investors have become more comfortable with the inflation outlook, the diversification benefit of bonds is beginning to return to portfolios.

What’s on Deck for August?

- Second quarter of 2025 earnings reports will wrap-up in August. Through July 28th, 32% of the S&P 500 companies had reported, 77% beat earnings estimates with a reported earnings growth of +5.5% year/year.

- The Federal Reserve Open Market Committee (FOMC) left interest rates unchanged in July. The Committee does not have a regular committee meeting in August; rather they have their annual symposium at Jackson Hole. Investors will be monitoring the meeting and communication for any insight as to the likelihood of an interest rate cut in September.

- Trade policy will again be front-of-mind as the August 1st deadline approaches for trade deal negotiations.