A review of November’s markets, including AI hyperscaler volatility, bond trends, and what to watch at the December Fed meeting.

November 2025 Market in Review: AI investment, Bond Performance, and Equity Markets

Month in Review

- The shifting economic outlook and renewed attention to the magnitude of artificial intelligence (AI) investment made for a volatile month for equity markets.

- US large caps managed to finish the month slightly in “the black” (S&P 500 TR Index; +0.25% in November), despite Technology stocks falling -4.3% during November (S&P 500 Information Technology Sector Index).

- The weakness in Technology stocks weighed on large cap growth stocks, which fell -1.81% during the month (Russell 1000 Growth TR Index), while large cap value stocks rose +2.66% in November (Russell 1000 Value TR Index).

- The shifting interest rate outlook was a tailwind to major bond markets, with the Bloomberg Barclays Aggregate Bond TR Index rising +0.62% during the month, taking 2025 returns to +7.46%.

AI Hyperscalers Pullback

AI-related companies, including the so-called AI-“Hyperscalers”, sparked an increase in volatility and a pullback of -5% at one point for US large cap stocks in November. While pullbacks of this magnitude are very common, investors appear to be paying close attention to the rapid increase, and shifting make-up, of the capital expenditures on artificial intelligence technologies.

Magnificent 7 stocks, and particularly the smaller sub-set of Hyperscalers, are broadly defined as the market leaders in AI investment technologies. They have also powered the S&P 500 Index higher, as they become an increasingly large percentage of the index. To-date, these companies have had above-market earnings growth and reached an expected $500bn of capital expenditures in the next 12-months, having previously done so without significant use of debt and borrowing. That changed starting in September.

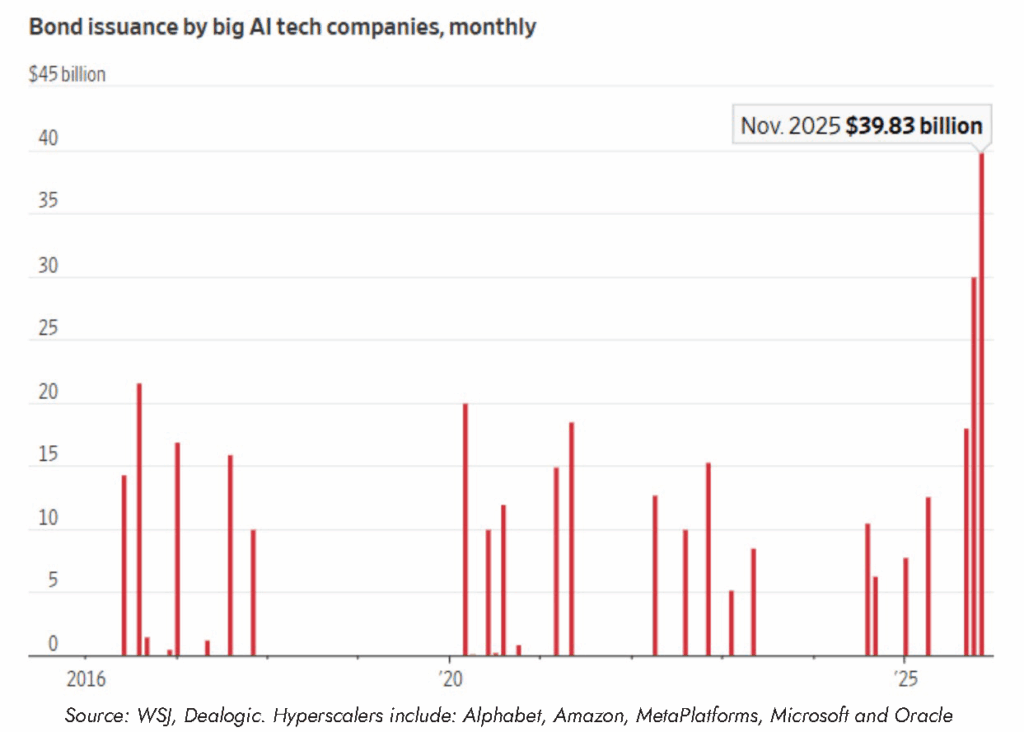

Since September, the Hyperscalers have issued nearly $90 billion of investment-grade bonds, more than they had sold over the previous 40 months. Investors are watching the shift from cash-flow funded to debt funded capital expenditures closely. It is important to note that earnings for these companies have largely kept up with share prices to-date; a difference from 1999-2000 when share prices rose rapidly ahead of earnings growth. However, given the highest concentration in over 50-years in the S&P 500 Index, investors continue to watch developments in artificial intelligence closely.

What’s on Deck for December?

- The Federal Reserve Open Market Committee (FOMC) meets December 9-10 where they will announce any changes to policy. At time of writing, financial markets are pricing a roughly 85% chance of a 0.25% interest rate cut.

- Investors continue to digest economic data following the end of the government shutdown. Some data releases over that period will not be released on a permanent basis.