732 E. McMurray Road, McMurray, PA 15317

732 E. McMurray Road, McMurray, PA 15317

From rebate checks to small business support, there is quite a bit packed into the Coronavirus Aid, Relief, and Economic Security (CARES) Act that was signed into law on Friday. The $2+ trillion emergency fiscal stimulus package is intended to mitigate some of the economic effects caused by the COVID-19 outbreak.

We have all been working to gain an understanding of the law so that we can act as a resource for our friends and family looking to take advantage of the applicable provisions. We have been reading numerous articles, participating in webcasts hosted by industry experts and large accounting firms, and talking with banks to understand the process for various provisions. New information is still coming out daily, but please do not hesitate to use us as a resource as we work through this pandemic.

Here is a look at some of the key provisions in the CARES Act that may be of interest to you:

What’s next? Treasury Secretary Steven Mnuchin has targeted early April to deliver the funds. Discussions are starting in D.C. around a possible next phase of economic relief, although it’s just talk for now.

We’ll continue to keep you updated with relevant and timely information. In the meantime, please don’t hesitate to reach out. These are difficult times in which we are living, but we are confident that we will get through them together.

The banking system recently became front-page news following the failure of two banks in March. The headlines related to bank failures can illicit very emotional responses about safety of deposit accounts and cash investment solutions.

Cash management fundamentally breaks down into two categories:

While the two have similarities, there are fundamental differences with structure and protection.

In addition to FDIC insurance and backing of the full faith and credit of the US government, most assets held at firms such as Raymond James are covered by the Securities Investor Protection Corporation (SIPC), to applicable limits. The SIPC was established in 1970 and protects client assets up to $500,000, including $250,000 of cash. SIPC account protection would apply in the event a firm fails financially and is unable to meet obligations to clients, not against a loss in market value.

Despite the negative and unsettling headlines, there are multiple robust cash management solutions available to clients, with multiple layers of risk mitigation. At Confluence Financial Partners, we believe in the soundness of our banking system and maintain complete confidence in our client cash management tools.

Month in Review

2nd Topic Here

Body text here….

What’s on Deck for August?

Month in Review

Insight on Inflation

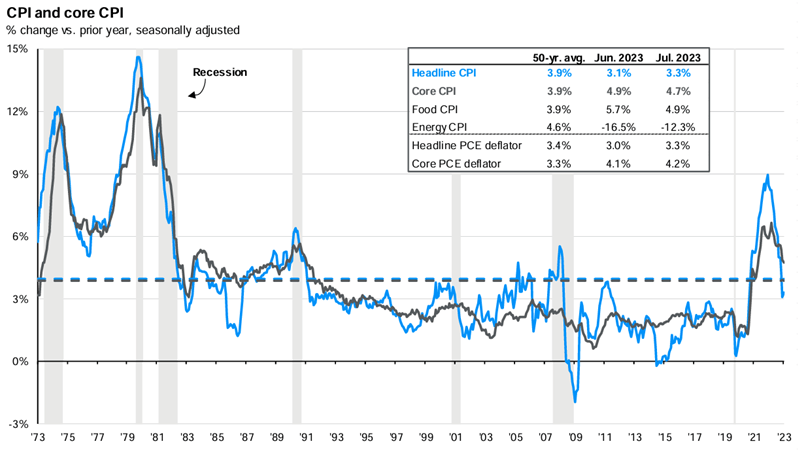

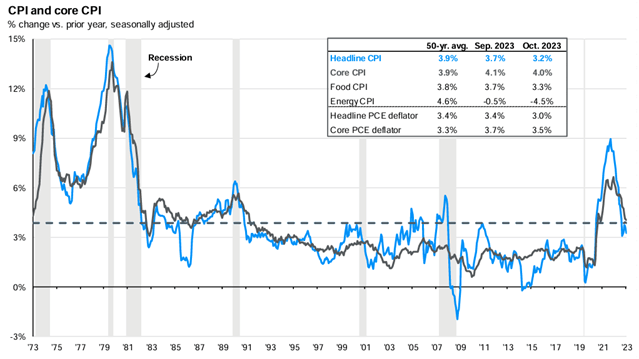

Despite the market volatility, evidence from July’s inflation report suggests progress towards a “soft landing” scenario, where inflation is gradually decreasing, and the economy avoids a recession. In July, headline inflation was at +3.3%, year-over-year, down from its peak of 9.1% in June 2022. Unlike June 2022, supply chains and goods have largely normalized, with wages and services being the key drivers of inflation today.

Source: BLS, FactSet, J.P. Morgan Asset Management. CPI used is CPI-U and values shown are % change vs. one year ago. Core CPI is defined as CPI excluding food and energy prices. The Personal Consumption Expenditure (PCE) deflator employs an evolving chain-weighted basket of consumer expenditures instead of the fixed-weight basket used in CPI calculations. Guide to the Markets – U.S. Data are as of August 31, 2023.

What’s on Deck for September?

Download the August 2023 Market Recap below:

Social Security, started in the 1930s as a part of FDR’s New Deal, has been under fire since I can remember. All the while, the program has been helping fund the retirement of some 47 million Americans, with another 19 million on survivor or disability benefits. What started out as a way to ensure elderly Americans had some form of income has turned into a major piece of the US economy.

As we help our younger clients plan for retirement, we often hear, “Let’s not plan on Social Security, I don’t think it will be there by the time I retire.” While we understand where this attitude is coming from, we don’t think it reflects reality.

As long as there are people working in the United States, there will be money going into, and then out of Social Security.

By the most recent estimates, the trust fund assets will be spent down by 2034. At that point, Social Security would officially be insolvent.

But what does insolvency actually mean?

No, it doesn’t. For younger workers who have plenty of time to factor such a possibility in their long-term planning, the potential reduction would not be life changing. A relatively modest increase to retirement savings would make up for the potential shortfall.

In reality, Congress will be forced to act, there will likely be changes to Social Security at some point. These changes will probably make sure that current benefits are not cut, and that Americans with no time to adjust will not have the rug pulled out from under them. For younger Americans, the fact remains that as long as we have workers and payroll taxes, Social Security will be there in one way or another.

Disclaimer: This analysis could certainly change pending action by Congress. We are in no way trying to predict the future, but we believe this analysis is reasonable based on the current landscape.

Month in Review

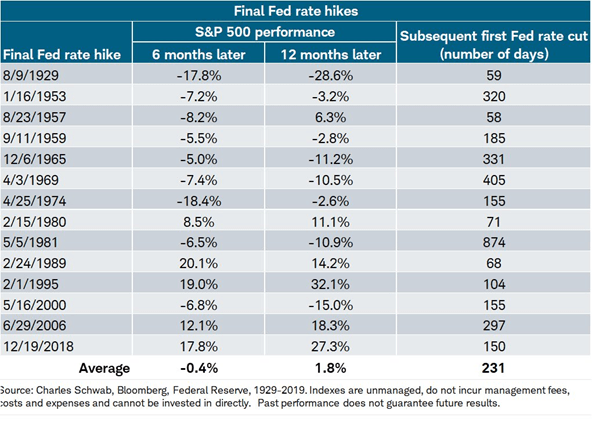

Last Rate Hike? Now What?

The Federal Reserve held its November committee meeting, where they kept interest rates unchanged. Following the press conference, investors are now expecting interest rates to be unchanged again in December (only a 15% probability of a December rate hike as of 11/2/2023). If the Federal Reserve is finished increasing interest rates this cycle, what does that mean for the stock market? Going back to 1929, there are no clear trends, the range of outcomes following the last hike is very wide historically. While various talking heads remain hyper-focused on short-term events such as this, it is more important than ever that investors maintain their focus on long-term fundamentals.

What’s on Deck for November?

Download the October 2023 Market Recap below:

If you were gone tomorrow, would your family be financially OK?

That is a jarring question, and one that most of us try to avoid.

As difficult as this scenario is to consider, however, we owe it to ourselves and our loved ones to be able to answer the question with certainty.

Below are some points to consider:

So, we ask again.

If you were gone tomorrow, would your family be financially ok?

If you aren’t sure, take time to reflect. We at Confluence Financial Partners have been helping clients answer that question in the affirmative for decades, and we would be honored to be able to help you as well. We know this isn’t a pleasant thing to work through, but it’s worth it, and you owe it to those you love.

Month in Review

A November to Remember!

November was a month to remember for investors: The S&P 500 posted its strongest November since 1980 (rising roughly 9%) and the Barclays Aggregate Bond Index had its best month since May 1985 (rising roughly 4.5%).

What were the catalysts for such a sharp reversal?

Investor sentiment had become overly negative – a three-month losing streak for stocks and a 5-month losing streak for bonds. This set-up was followed by unexpected positive developments on the fight against inflation. Multiple readings during November showed inflation rising by less than expectations. Federal Reserve officials also affirmed progress towards normalizing inflation, the decline can be seen in the exhibit below. The positive developments on inflation drove interest rates lower, sending stock and bond prices higher, as investors now shift their attention away from rate hikes to rate cuts.

Source: BLS, FactSet, J.P. Morgan Asset Management. CPI used is CPI-U and values shown are % change vs. one year ago. Core CPI is defined as CPI excluding food and energy prices. The Personal Consumption Expenditure (PCE) deflator employs an evolving chain-weighted basket of consumer expenditures instead of the fixed-weight basket used in CPI calculations. Guide to the Markets – U.S. Data are as of November 30, 2023.

What’s on Deck for December?

Download the November 2023 Market Recap below:

As enthusiasts and collectors approach the later stages of their lives, the act of collecting takes on new dimensions. Some may be content to sell their collection and pass the proceeds on to heirs, but for others the treasures that have been amassed over the years are now an opportunity to leave a legacy that will continue to endure.

Here are four considerations to help navigate this phase of your collecting journey:

If you haven’t already, start to incorporate your collection into your broader estate plan. Decide how your treasures will be managed, preserved, or passed on. Engage with experts who specialize in collectibles and estate management, particularly those well-versed in the tax implications of transferring collections.

Consider which heirs will receive each item and why, taking into account their emotional significance and potential for instilling responsibility. If you aim to establish a philanthropic legacy, donating to a museum or organization aligned with your mission not only offers tax benefits but also ensures parts of your collection remain together.

While financial considerations have likely played a role in your collecting journey, the emotional value of your treasures becomes increasingly significant as you near this phase. Embrace the joy and memories your collection evokes. If the next chapter is one that doesn’t fetch your estate the highest possible payout or the most optimal tax deduction, that can be OK if the destination fulfills your wishes and maximizes the emotional component of the transition.

Consider the broader impact your collection can have. Some individuals opt for philanthropic endeavors that align with the themes of their collection. For example, a collector of classic cars may choose to donate his or her collection to an automobile museum that will display the vehicles and allow them to continue to provide joy for many. Donating items, contributing proceeds to charitable causes, or establishing cultural endowments can solidify your legacy as one that extends beyond material possessions.

Once you’ve established a robust plan for your collection, it’s crucial to have capable individuals ready to carry it out. For vehicles, consider arranging for an appraisal in advance or identify a trusted appraiser to guide those handling your estate. If you anticipate liquidating a coin collection after your passing, take the initiative to identify a reputable precious metals dealer beforehand. By personally selecting the third parties involved, you can alleviate the executor’s potential challenges in managing and distributing your collection.

As your collecting journey matures, it evolves into a narrative of legacy and stewardship. It’s important to recognize that your collection signifies not just an investment, but a testament to the diverse experiences of your life. Take the necessary time and consider that at Confluence Financial Partners, we’re here to help. Collaborating with the right professionals can help ease the burden and ensure both your life and legacy are maximized.