Markets Power Higher Through Noise

- The longest government shutdown in history, slowing job creation, and concern over sustainability of AI investment did not slow down equity markets in the Fourth Quarter.

- Record concentration in the S&P 500 in the US, driven in large part by the enormous spending on AI, caused some volatility during the quarter. Market concentration will likely be closely watched by investors in 2026.

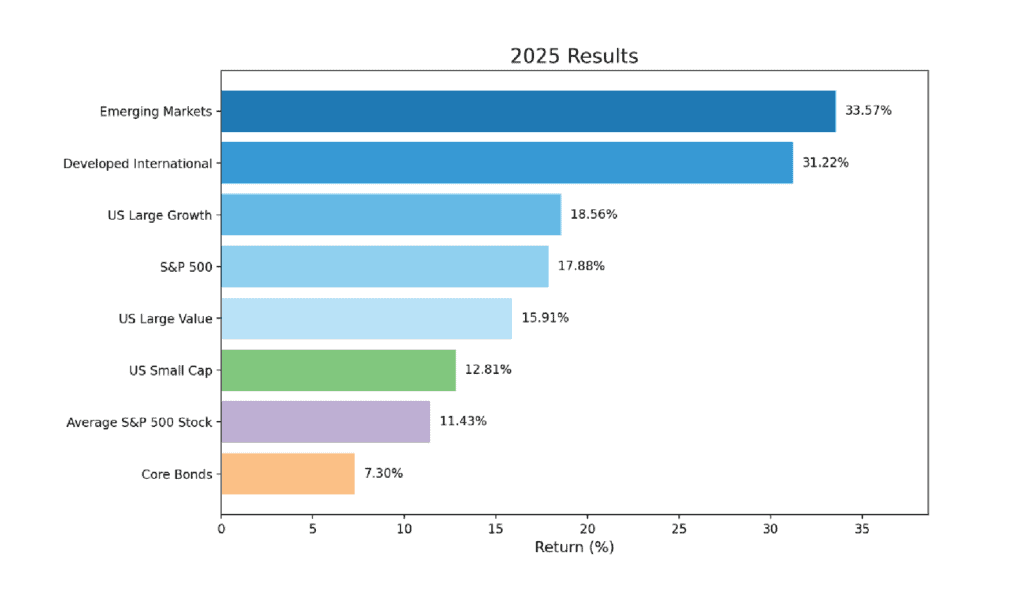

- Ultimately, stock and bond markets finished 2025 on a high note, particularly for diversified investors: international equity markets posted strongest relative results to the US in over 30 years.

- Strong finish and year was supported by fundamentals: higher earnings growth internationally, and strong earnings in the US that allowed the market to “grow” into historically expensive valuations.

What Happened in the Fourth Quarter and 2025?

The Fourth Quarter of 2025 finished on a strong note, with all major equity markets finishing in positive territory. This is despite an increase in volatility in October and November, following the longest government shutdown in US history, and investor concern around the sustainability of the massive investment in Artificial Intelligence. The government shutdown resulted in some economic data being suspended, but alternative measures showed that the economy was creating fewer jobs during the fourth quarter. In the stock market, strong earnings were the name of the game throughout 2025- outside the US, there was a strong embrace of fiscal stimulus, which powered earnings growth higher in Europe and Japan. The stronger-than-expected earnings growth, along with a weakening US dollar, resulted in international equity markets having their best relative results to the US since 1993 (via MSCI World Ex-US Index and S&P 500 Index). In the US, the S&P 500 started the year historically expensive and stayed that way throughout 2025, ultimately producing a third consecutive year of double-digit gains (historically rare occurrence). The S&P 500’s valuation largely stayed constant during 2025, reflecting strong growth in earnings that was responsible for nearly all of the index’s 2025 results. The growth-driven market did result in the trailing dividend yield on the S&P 500 Index hitting its lowest point since 2000 (1.20%), in contrast to higher yielding international equity markets.

Sources: Morningstar, Average S&P 500 Stock = S&P 500 Equal Weighted TR Index, US Large Caps = S&P 500 TR Index, US Small Cap = Russell 2000 TR Index, Developed International = MSCI EAFE NR Index, Emerging Markets = MSCI Emerging Markets NR Index, Core Bonds = Bloomberg US Agg Bond TR Index, US Large Growth = Russell 1000 Growth TR Index, US Large Value = Russell 1000 Value TR Index

The bond market was a benefactor of falling inflation and interest rate cuts from the Federal Reserve, resulting in the bond market (Bloomberg US Agg Bond Index) having its strongest calendar year since 2020, finishing comfortably above cash for the year. Short-term interest rates have fallen faster than long-term interest rates (“steepening yield curve”), as the Fed delivered three rate cuts in 2025 (following three cuts in 2024). Investment grade and high yield bonds also had a strong quarter and year, with spreads falling to low levels as the economy continued to grow. The outlook for additional rate cuts shifted during the quarter, with a roughly 60% chance of a 0.25% rate cut in March 2026 priced by the market (as of 1/1/2026).

All About Artificial Intelligence

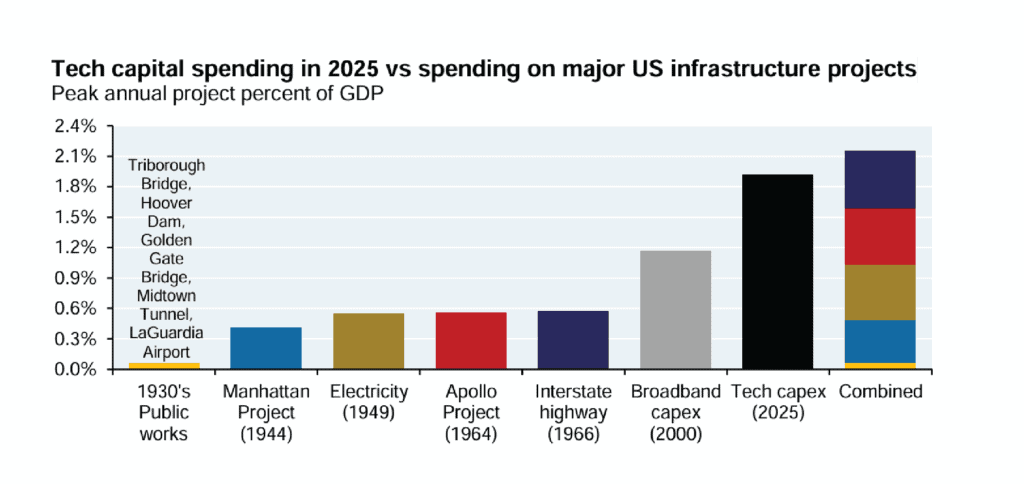

The investment in Artificial Intelligence technologies is on track to be the largest investment in US infrastructure in 100 years. The magnitude of investment had an impact on both the economy and stock market in 2025. For example, the chart below illustrates capital expenditures by the Technology sector as a percentage of US gross domestic product (GDP). It compares the current investment in AI technologies to other major infrastructure investment cycles historically – the current is significantly higher than the amount invested in Interstate highways and the Apollo Space Project, for example.

Source JPMorgan,: Manhattan District History, BEA, Planetary Society, Eno Center for Transportation, San Francisco Fed, Hoover archives, Baruch, GoldenGate.org, New York Times

This had a tangible impact on economic data: investment in AI data centers was responsible for almost all of the economic growth in the first six months of 2025, more than consumer spending which is 2/3 of long-term GDP growth!

As discussed in previous editions of Market Pulse, the massive investment from Technology companies has also had a profound impact on equity market results and composition. In the United States, this has meant an increasingly concentrated equity market (over 40% of the S&P 500’s value is in ten companies), and a continuation of the outperformance of larger companies versus smaller companies. For example, the S&P 500 has outperformed the S&P 500 Equal Weight Index (average stock) by 34% over the past 3 years, the widest 3-year performance gap in history. US large cap stocks also outperformed small cap stocks in 2025, marking the 5th consecutive year of large cap outperformance. Investors expect there to be benefit to other companies within the stock market, forecasting a narrowing gap of earnings growth between the 10 largest companies and the rest of the stock market.

What’s Ahead for the First Quarter?

Investors will be watching for early clues in the tug-of-war going on between slowing job growth and expectations of a reaccelerating economy through the stimulus from the One Big Beautiful Bill Act (OBBA). The latter is expected to produce higher-than-average Federal tax refunds, which should be a boost to consumer spending. On the other side, expectations are for job growth to slow to under 50,000 new jobs per month, one sign the economy is slowing down. Inflation is a key reason the market is only expecting one 0.25% rate cut in the first quarter: core inflation is falling but remains stubbornly above the Federal Reserve’s target level of inflation. The equity market is coming off another year of strong results: the S&P 500 had double digit returns for three consecutive years for just the 9th time since 1928. Investors will look for signs of broadening participation from smaller companies, and improvement in earnings growth outside the mega-cap Technology companies.

Past performance is not indicative of future results. The S & P 500 Index is a broad, unmanaged index of 500 of the largest US publicly traded companies and does not reflect the impact of fees, taxes or expenses. Any investment in the S&P 500 or similar indices, like the Russell 1000 and Russell 2000, involves risk, including the potential loss of principal and they do not reflect the costs of investing in an actual portfolio. Investors should consider their individual risk, tolerance, investment objectives, and consult with a financial professional before making investment decisions.