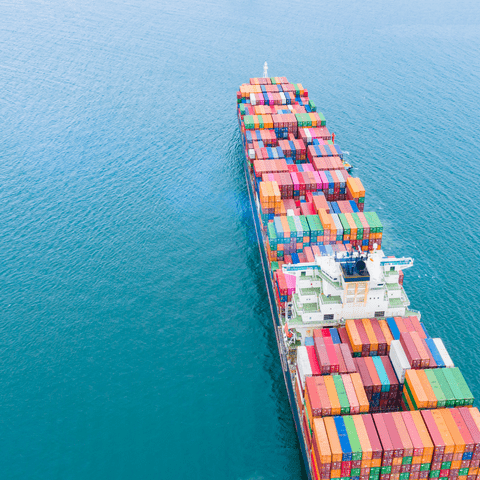

After a long hiatus, inflation has made quite a comeback in everyday lives of consumers around the world. Generally defined as the increase in the prices of goods and services in an economy, inflation had been below historical averages most of the past decade, with the backdrop of a longer-term decline since peaking in the early 1980’s. The COVID-19 pandemic was the catalyst for a revival, initially due to constraints on supply chains and global trade. However, as economies globally recovered from the pandemic, inflation readings continued to show signs of growth.

The phenomenon was initially described as “transitory” by economists and investors, believing that inflation would slow as supply chains and global trade healed. This assumption proved to be incorrect, with the “transitory” description has been dropped since mid-2021, as all major measures of inflation have continued to increase at a consistent and rapid pace. The most commonly referenced inflation measurement, the Consumer Price Index (CPI), is tracked including food and energy prices (headline CPI) and excluding food and energy prices (core CPI). The reading through February showed that compared to one-year ago, headline CPI rose +7.9% and core CPI rose +6.4%, the highest level in almost 40-year for both readings. Importantly, this reading does not account for the subsequent increase in energy and other commodities after the escalation in Ukraine.

Inflation is an impactful force to the global economy and therefore financial markets; the sharp increase certainly has the attention of policymakers. In the United States, the Federal Reserve operates under a “dual mandate” of “price stability and maximum sustainable employment”, with the former goal referencing inflation. Due to the improvement in the labor market, and consistently high inflation readings, the Federal Reserve is expected to raise interest rates starting in the March meeting. The first increase will mark the start of tighter monetary policy, which will influence equity and bond markets in the short-term. The additional unknown duration of the supply disruptions in the oil and gas market will also muddy the waters for policymakers over the coming months.

The long, secular decline in inflation readings is over in the short-term. With inflation readings already near 40-year highs prior to the conflict in Ukraine, the response by policymakers over the coming months will be widely followed by investors. As we transition to a rate hiking cycle and inflation stays firm, the environment will likely require investors to shift their approach. Looking back historically over periods of rising inflation, asset classes such as commodities, real estate, value equities, US small cap equities and international equities tended to do well. Within equities, dividend paying stocks may offer an attractive opportunity for investors seeking growth with income in an inflationary environment. One additional portfolio consideration for investors: inflationary periods have had implications for the relationship between stock and bond returns, with high and rising inflation historically reducing the diversification benefit from bonds (positive correlation between stocks and bonds). While the approach may be different than the past 20 years for investors, there are likely to be opportunities for long-term investors to take advantage of as we navigate the ever-changing investment environment.

Views and opinions expressed are current as of the date of this white paper and may be subject to change; they are for informational purposes only and should not be construed as investment advice. Prior to making any investment decision, you should consult with your financial advisor about your individual situation. Although certain information has been obtained from sources considered to be reliable, we do not guarantee that it is accurate or complete.

Forecasts, projections, and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with such forward-looking statements, it is important to note that actual events or results may differ materially from those contemplated.

Confluence Wealth Services, Inc. d/b/a Confluence Financial Partners is an SEC-registered investment adviser. Registration of an investment adviser does not imply any level of skill or training. Please refer to our Form ADV Part 2A and Form CRS for further information regarding our investment services and their corresponding risks.