A Monthly Review of Investment Trends and Insights

Month in Review

- Increased likelihood of an interest rate cut in September helped to push stocks higher, along with another quarter of strong earnings. The S&P 500 TR Index finished August +2.03% higher.

- US small cap stocks led all equity markets higher, as the combination of inexpensive valuations and potential interest rate cuts proved to be a tailwind in August. The Russell 2000 TR Index rose +7.14% in August, bringing the return since 6/30/2025 to +9.00%.

- Reversing July’s rally, the US Dollar fell again in August, providing an additional boost for international stocks denominated in US dollars. The MSCI EAFE NR USD Index rose +4.26% for the month, taking the YTD 2025 rally to +22.79%.

- The likelihood of a September interest rate cut pushed short-term bond yields lower, helping to drive a +1.20% monthly rally for major bond markets (Bloomberg Barclays Aggregate Bond TR Index). It is important to note that longer-term bond yields actually rose slightly during the month.

Small Caps Shine in August

US small cap stocks, which are in the midst of one their longest period of underperformance versus US large caps, rallied sharply in August (Russell 2000 TR Index +7.14%, S&P 600 TR Index +7.06%). The primary reason – clarity around the now widely expected interest rate cut in September.

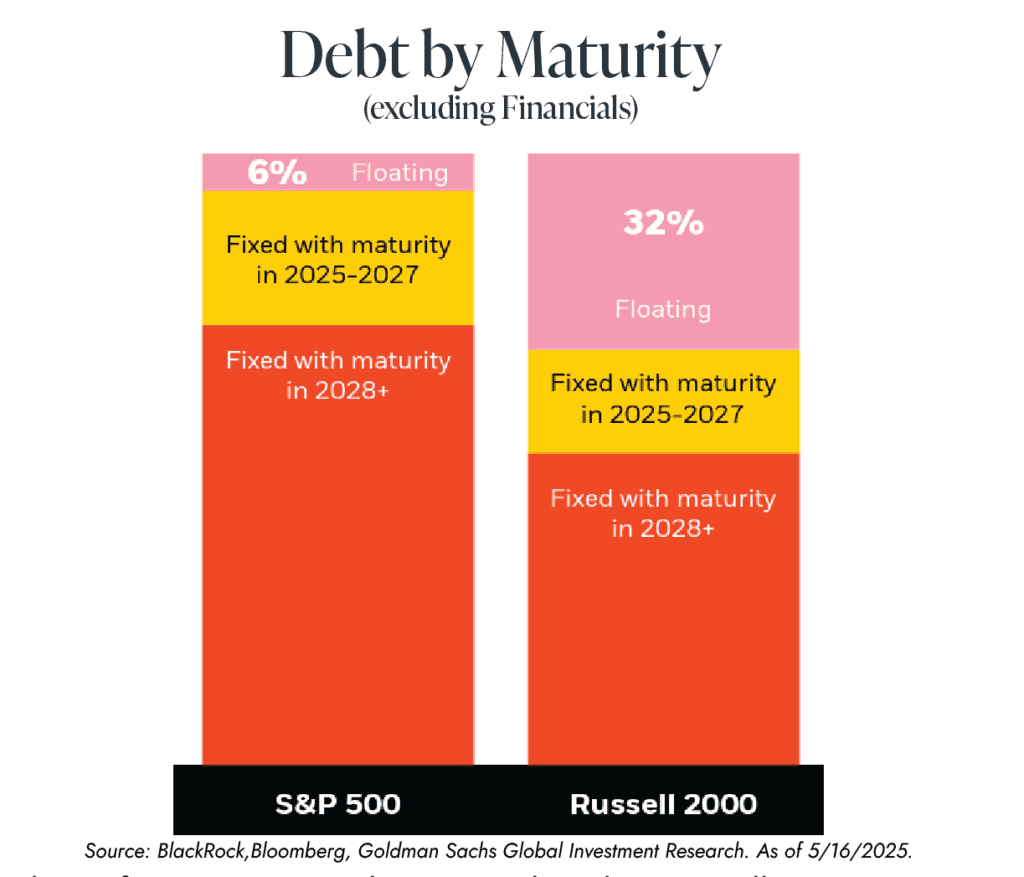

US small cap stocks have significantly greater exposure to short-term interest rates, having nearly 5x the amount of floating rate debt compared to the S&P 500 (chart below). Given that the Federal Funds Rate, the anchor for floating rate debt rates, has been above 4% since December 2022, small cap debt service costs have also been elevated. Effective annual debt cost for the Russell 2000 Index is closer to 7%, significantly higher than the effective rate for the S&P 500, which had more companies issue longer-term, fixed rate debt.

The nearly 12-year period of underperformance versus large caps has driven small caps to represent less than 4% of the overall US stock market, much lower than the 7% long-term average. The start of an interest rate cutting cycle is one element that could benefit small cap stocks. Their valuations are also much lower than US large cap stocks, which could also be a tailwind if the economy continues to expand, and catalyze increased representation of small caps.

What’s on Deck for September?

- The Federal Reserve Open Market Committee (FOMC) announces their decision to change interest rates on September 17th. As of August 31st, markets are assigning a roughly 90% probability that the FOMC reduces the Fed Funds Rate by 0.25%.

- The Federal Reserve staffing is also in the spotlight. In August, President Trump announced intentions to remove Fed governor Lisa Cook, on allegations of mortgage misrepresentation. No Fed governor has been fired since creation of the Federal Reserve in 1913. The outcome will be watched closely by investors as there are implications for Fed composition and approach to monetary policy.