Month in Review

- Diversification was the name of the game in January, with value stocks, small cap stocks, and international stocks leading markets higher, as the S&P 500 finished January up +1.45% (S&P 500 TR Index)

- Weakness in Technology stocks continued for the second straight month, causing the large cap growth stock index to fall -1.51% in January (Russell 1000 Growth TR Index). In contrast, large cap value stocks started 2026 strongly, with the Russell 1000 Value TR Index rising +4.56% in January.

- Small caps and international stocks continued their strength as well, with the small caps rising +5.35% (Russell 2000 TR Index) and international stocks rising +5.98% (MSCI ACWI Ex-USA NR USD Index) in January.

- Bond markets were nearly unchanged during the month (+0.11%, Bloomberg Barclays US Aggregate Bond TR Index), as investors balanced the steady decline in inflation with the nomination of a new Federal Reserve leader.

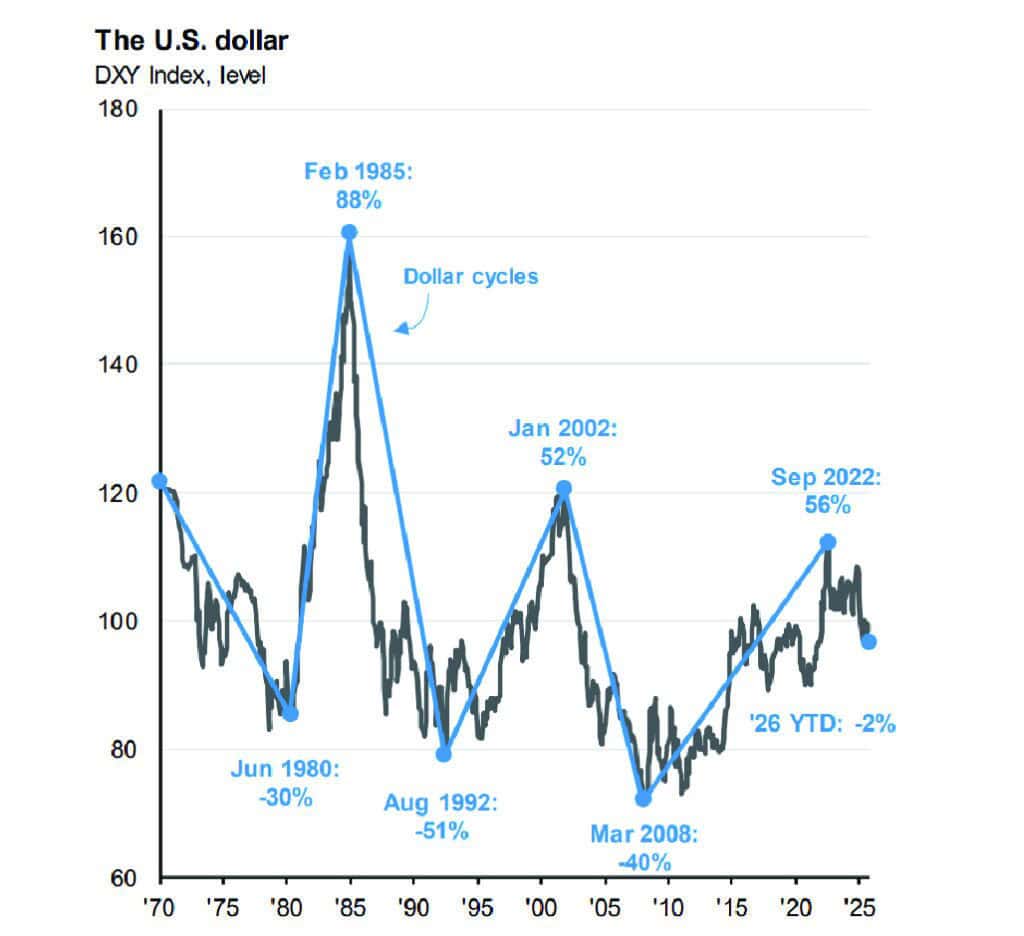

US Dollar Continues to Weaken

The US dollar continued to decline versus major currencies in 2026, falling roughly -2% in January. The decline in 2026 follows-up a decline of 9.4% in 2025, which was the worst calendar year for the dollar since 2017. There are many potential causes to the decline over the past 13 months, such as: changes in interest rates, starting valuation of the dollar, and changes to the fiscal outlook for the United States. The decline also has tangible impact on stock and bond markets, particularly coming off of a bull market for the dollar that lasted from March 2008 to September 2022.

For stock markets globally, the effect of the decline is two-fold. For US-based companies, especially large cap stocks in indices such as the S&P 500, a weakening dollar does boost earnings growth for these companies (unlike the US economy, S&P 500 Index generates 30% of sales from overseas).

For international equity markets, it has been a boon for US-based investors. US-based investors owning international stocks have three sources of return: share price + dividend yield + currency impact. The depreciation of the dollar added almost 8% to the return of the international stock market for US-based investors in 2025 (+32.39% in 2025, MSCI ACWI Ex-USA NR USD Index). This continued in January with a roughly 1.4% boost via currency (+5.98% in January, MSCI ACWI Ex-USA NR USD Index). Continued weakening of the US dollar could be a positive factor for US investors that own international stocks. For commodities and currency alternatives, dollar weakness has been a mixed bag: gold shined (+9.31% in January, S&P GSCI Gold Spot Index), while Bitcoin struggled (-4.29% in January, S&P Bitcoin USD).

Source: Bloomberg, FactSet, J.P. Morgan Asset Management; Currencies in the DXY Index are: British pound, Canadian dollar, euro, Japanese yen, Swedish krona and Swiss franc.

What’s on Deck for February?

- Earnings seasons covering the fourth quarter of 2025 continues in February, with the majority of the Index’s market capitalization reporting in late January and early February. AI-related investment and consumer strength will be the key themes watched by investors.

- The Federal Reserve Open Market Committee (FOMC) held interest rates constant in January. Kevin Warsh was nominated to serve as the next Chairman of the Federal Reserve – he will begin the confirmation process.