A Review of Investment Trends and Insights

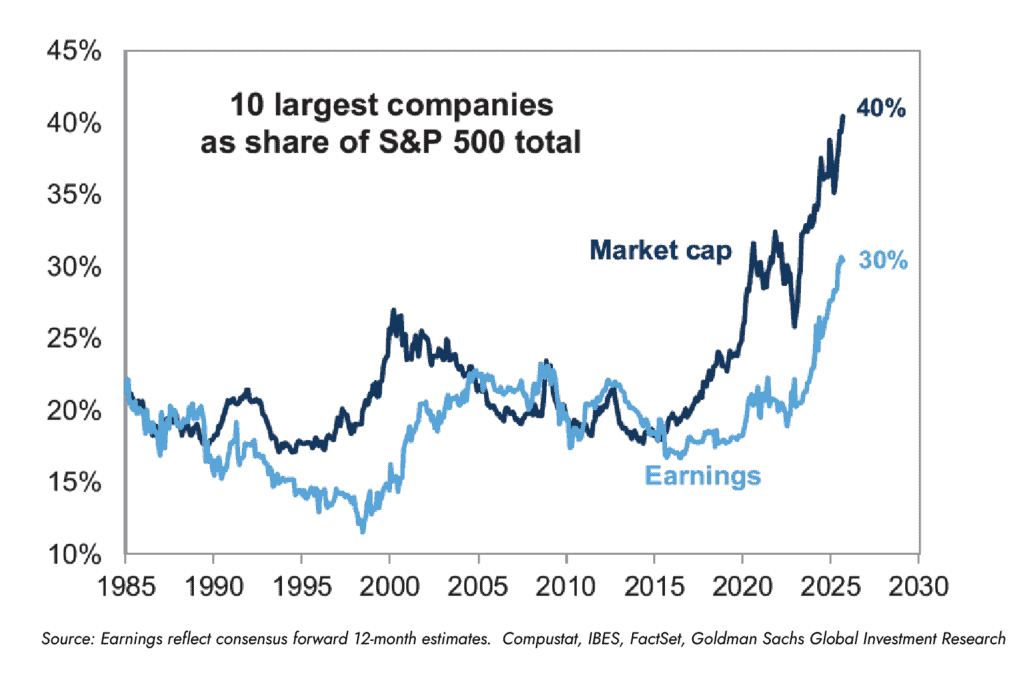

Record Concentration

- Federal Reserve reduced interest rates for the first time since 2024 following weakening labor market data.

- Declining interest rates helped drive US small cap stocks and bond markets higher during the quarter.

- Investment in artificial intelligence drove the S&P 500 to record concentration levels as leadership narrowed in the Third Quarter.

What Happened in the Third Quarter?

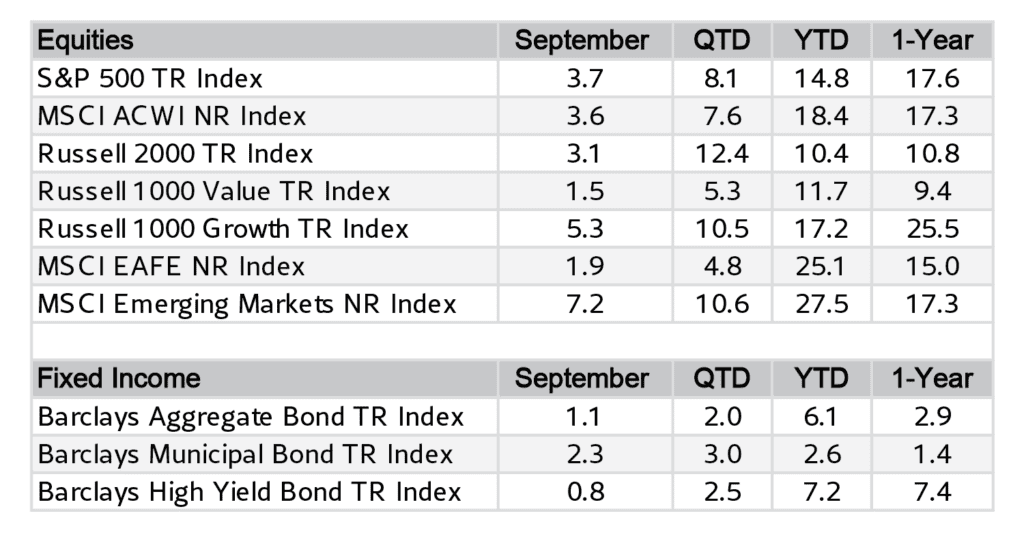

The first interest rate cut since the end of 2024 and why it happened were important events in the Third Quarter of 2025. The Federal Reserve had been consistent with their messaging – interest rate cuts would largely be determined by any weakness in the labor market. During the quarter, there became signs the labor market was slowing down. There were large revisions to previous estimates of job creation, showing that the economy had created fewer jobs than first assumed. With inflation still comfortably above their 2% target, Federal Reserve officials were still comfortable reducing the Federal Funds Rate by 0.25% in September, reflecting the slowing jobs market. During the lead-up to the interest rate cut, equity markets were led by interest-rate sensitive markets such as small caps, which had strong results during the quarter (Russell 2000 TR Index rose +12.39%). Bond markets also benefitted from the decrease in interest rates, with the Bloomberg Barclays US Aggregate Bond TR Index rising +2.03% during the quarter. Leadership within the S&P 500 Index narrowed again during the quarter, as the largest companies (and most exposed to artificial intelligence investments) drove the index higher – detailed more below.

Index Diversification in the Spotlight One defining characteristic of the past three-to-five years in the US equity markets is the increasing concentration in the S&P 500. The degree to which the S&P 500 has narrowed has led to many investors asking “is an S&P 500 Index investment still diversified?”. By any measure – the S&P 500 Index is more concentrated in the largest companies than any other time since at least the mid-1960’s.

The top 10 companies in the S&P 500 make up 40% of the index market capitalization- meaning for every $1 invested in the S&P 500 Index, $0.40 goes into 10 companies. This compares to an average top 10 concentration closer to 23% over the past 30 years. Similar measures reflect the magnitude of concentration: Nvidia became the first 8% or greater position since IBM in 1969, Top 5 companies reached almost 28% of the index (highest since at least 1966).

The “why” of index concentration is also an important question- JPMorgan and Berkshire Hathaway are the only two Top 10 members that aren’t technology/technology-related companies. The significant capital expenditures related to artificial intelligence has shaped market composition: Magnificent 7 companies have doubled their annual capital expenditures since 2023. Investors will continue to be focused on the return-on-investment of this record investment, as well as the benefit to the other 490+ companies in the equity market.

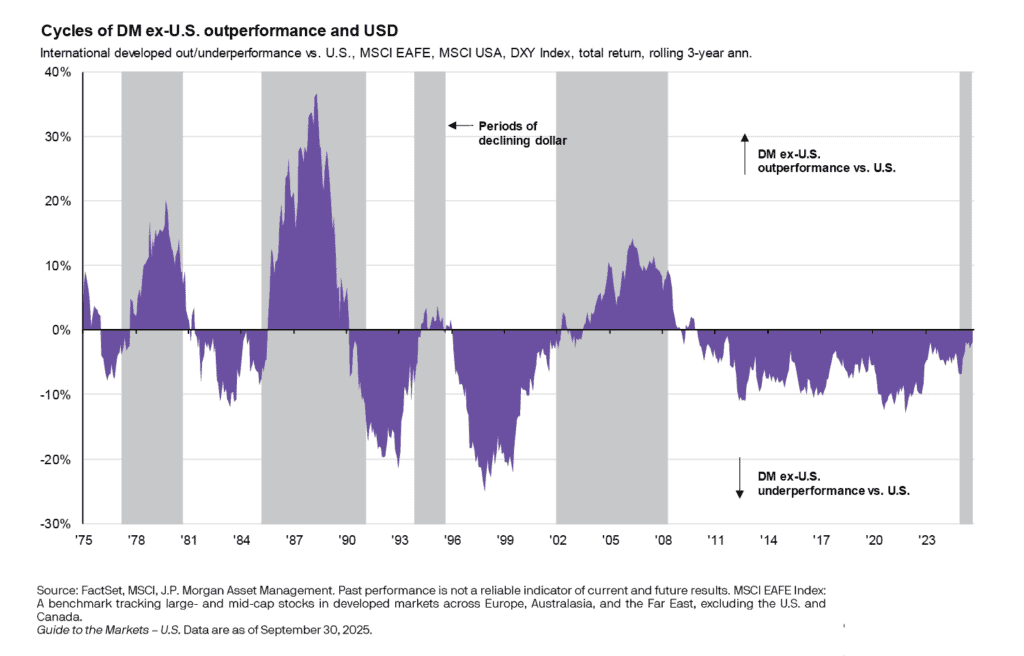

Impact of US Dollar Trends

After falling almost -11% in posting its worst first half of a year since 1973, the US dollar rallied mildly during the Third Quarter. The weakness in the dollar has been a tailwind for international assets, such as international equities in investor portfolios. Converging growth rates and interest rate differentials globally, along with the high starting value of the US dollar heading into this year, leaves the possibility for an extended period of weakness, similar to 2002-2008. This period was also the last time international equities outpaced US equities for an extended period of time. Outside of currency trends, unlike the S&P 500 the international markets have a much lower degree of concentration in the largest companies: MSCI EAFE Index has roughly 12.7% of its market capitalization in the Top 10 holdings.

What’s Ahead for the Fourth Quarter?

Monetary policy is squarely in investors’ focus heading into the Fourth Quarter of 2025, with two subjects in focus. First, the path of interest rate cuts: what is the likely hood of additional interest rate cuts in 2025? With weakening in job market data in September, investors were assigning a high likelihood of rate cuts (0.25%) during the October and December Federal Reserve Open Market Committee meetings. This would mean an additional 0.50% reduction in short-term interest rates by the end of 2025, which would lower the yield on cash/cash-related investments (i.e. money market investments). Second, the composition of the Federal Reserve is also in focus, via both terms ending and attempts to replace members prior to the end of their respective term. This will have a significant impact on additional interest rate cuts heading into 2026.

Markets in Review