Month in Review

- Markets rebounded after the first 5% drop in April, with all major stock and bond markets finishing May in positive territory.

- Technology powered large cap growth higher (+5.99%, Russell 1000 Growth TR Index), leading all equity markets higher during the month. Small cap stocks rebounded during the month of May, with the Russell 2000 rising +5.02% (Russell 2000 TR Index). Outside the United States, developed international and emerging market equities both rose in May.

- Major bond markets also rallied higher in May as investors’ outlook for interest rate cuts stabilized. The Barclays Aggregate Bond TR Index rose +1.70% in May.

Improving Fundamental Picture

Equity markets are off to a strong start to 2024, despite surprising persistence of inflation and higher-for-longer interest rates.

What has been driving markets higher through these headwinds?

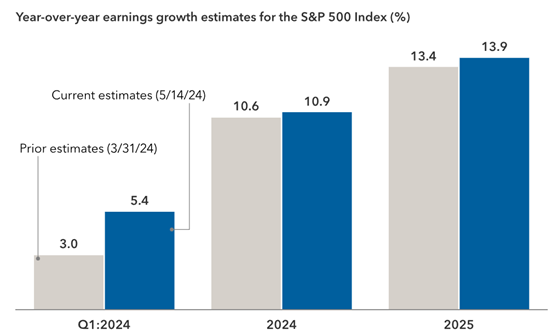

This year has been characterized by improving fundamentals, both with corporate earnings and dividends rising above expectations. First quarter earnings for the S&P 500 have risen nearly twice the estimates from earlier in 2024, and investors have also increased 2025 earnings growth estimates to nearly +14%. Increased investments in technology, along with the supporting infrastructure, appear to have been underestimated by investors heading in 2024. Estimates for growth in 2024 and 2025 have also increased for US small cap stocks and international stocks.

Dividends are also tracking ahead of expectations, thanks in part to an increase in dividend payments among technology companies. S&P Dow Jones estimates the S&P 500 dividend to increase by 6% in 2024, compared to a 5% increase in 2023. Over the long-run, stocks will follow fundamentals, and corporate earnings and dividends have been a positive surprise in 2024.

What’s on Deck for June?

- No rate cuts are expected, but investors will continue to focus on inflation data and Federal Reserve communication throughout the month.